Producing FRS102 Section 1A accounts in AccountsAdvanced - with QuickVid

Note: Section 1A is only applicable to FRS102 accounts. Section 1A cannot be applied to FRS101, IFRS or UKGAAP accounts.

The Financial Reporting Council (FRC) released FRS102 section 1A to govern small entities. Adoption of the standard is mandatory for small companies reporting under FRS102 whose accounting period starts on or after 1 January 2016.

Small company thresholds

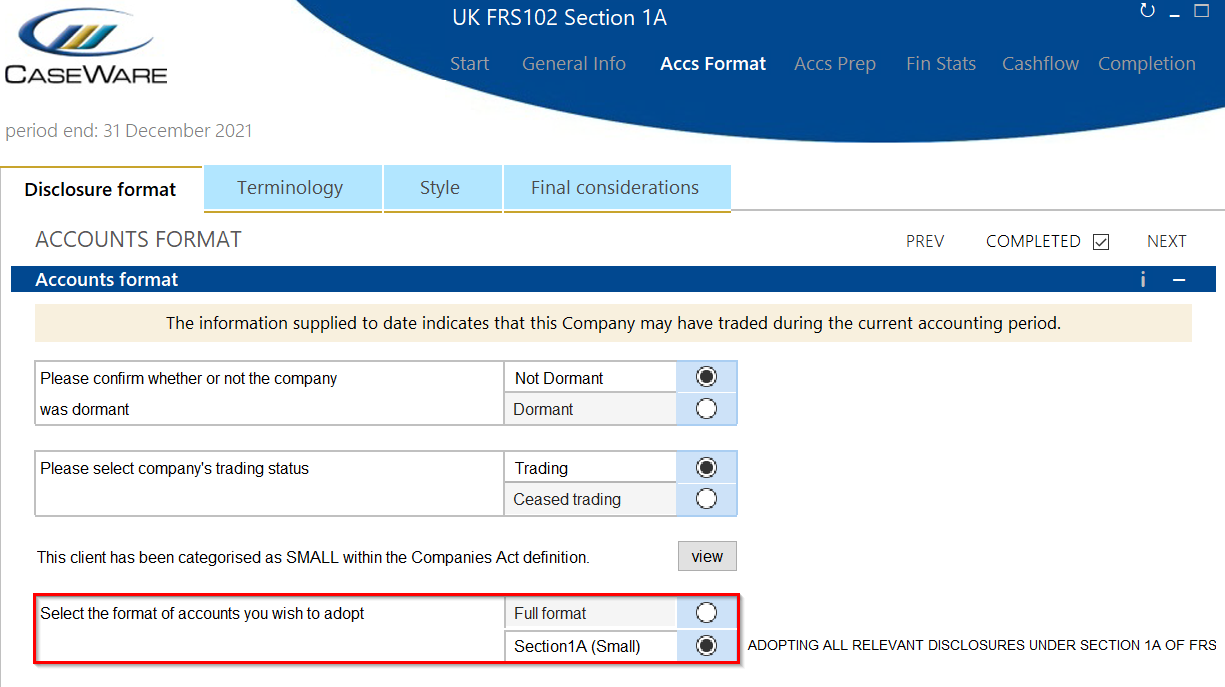

To qualify as a small company, the entity must satisfy at least 2 of the following 3 size thresholds:

- Turnover – Less than £10.2m (€12m)

- Gross assets – Less than £5.1m (€6m)

- Average no. of employees – Less than 50 (10)

1. The company size is calculated in the Start section of the Wizard.

2. Click on the Company Size tab to view the gross assets and turnover amounts, calculated from the trial balance.

3. Enter the average number of employees into the blue input boxes.

4. To adopt the Section 1A format, access the Accs Format section of the Wizard.

5. Open the Disclosure Format tab and select the option for Section 1A (Small).

6. Further down the Disclosure Format section, choose between Full/Abridged/Adapted formats for the Balance Sheet and Profit and Loss Account.

Visit our Client Services YouTube Channel for more QuickVids.

- Related template: FRS101/102/105 LLP

- Software platform: Working Papers 2018, Working Papers 2019, Working Papers 2020, Working Papers 2021, Working Papers 2022