How to produce FRS102 Section 1A Small Company Filing Copy accounts in AccountsAdvanced - With QuickVid

The Small Filing Copy is the version of the Accounts which are submitted to Companies House.

1. Activate it via the Accounts Completion section of the Wizard by changing the selection from Full statutory a/cs to Small Company Filing Copy.

2. The below prompt will appear, advising that shading has been removed from the Cover Page for filing.

3. The Small Filing Copy leaves just the following in the Accounts:

- Company Information Page

- Contents Page

- Balance Sheet

- Balance Sheet notes

Section 444 (1) of the revised Companies Act 2006 states that the Directors of a company subject to the small companies regime:

- Must deliver a copy of the Balance Sheet

- May deliver a copy of the company’s Profit and Loss Account and a copy of the Directors’ Report

The Profit and Loss Account and Directors’ Report are, therefore, not included by default. If the director(s) choose to deliver either of these, they can be switched on via the Accounts Preparation Table in the Wizard.

4. Use the dropdown menu next to the disclosure and select Yes to switch the section on.

Section 444 (2) states that, if a company chooses to deliver a Profit and Loss Account, it should also include an Auditor's Report (where applicable).

5. Switch on the Audit Report via the Accounts Preparation Table.

When a Profit and Loss Account is not filed, the following note will appear at the foot of the Balance Sheet to comply with section 444 (5A):

The first two paragraphs are very similar, but both need to be present for tagging purposes.

Additional information on specific items in relation to the Small Company Filing Copy from the ICAEW guidelines:

1. Employees Note (section 7)

The guidance given is that employee numbers should continue to be disclosed in the Small Company Filing Copy. This corresponds with the default settings in the Company AccountsAdvanced template for small companies, where the average number of employees in the year is disclosed by default.

2. Note Numbering (section 8)

When the Small Company Filing Copy is selected and notes to the Profit and Loss Account are omitted, those remaining are re-numbered to provide continuity

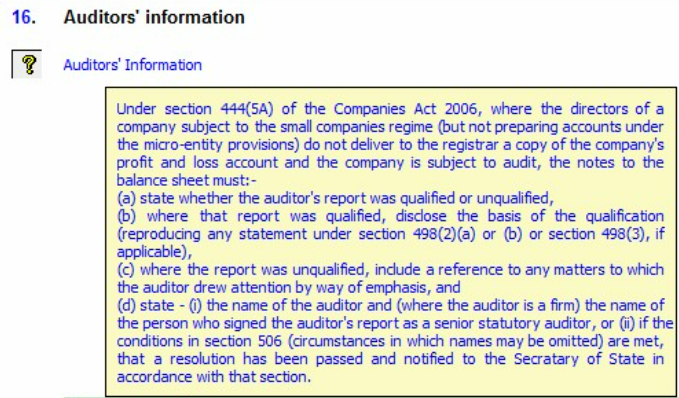

3. Audit Report (section 11)

Where a small company cannot take advantage of an audit exemption as specified in Companies Act 2006, it will be subject to a full audit. When producing full accounts, an auditor’s report on the financial statements would be included. However, when the Small Company Filing Copy is produced, this report is omitted, although there is a requirement to provide information related to the audit (this is specifically required where the Profit and Loss Account is not delivered). This is included in the Auditors' information note below which can be switched on via the Accounts Prep Table.

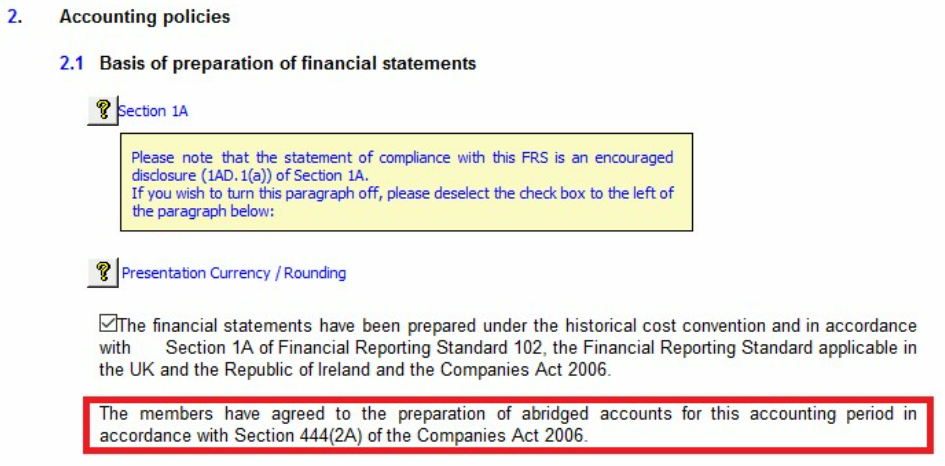

4. Consent to produce abridged layouts (section 14)

Section 444 requires that when an abridged layout of the Balance Sheet and/or Profit and Loss Account has been adopted, a statement that all members have consented to the abridgement is delivered to the Registrar. This statement is included within the Basis of Preparation accounting policy (see below). It must be triggered by selecting the Abridged layout(s) on the Disclosure Format section of the Wizard (also shown below).

Statement that consent for abridgement has been granted:

Options to be selected to trigger abridgement consent statement:

Visit our Client Services YouTube Channel for more QuickVids.

- Related template: FRS101/102/105 LLP

- Software platform: Working Papers 2018, Working Papers 2019, Working Papers 2020, Working Papers 2021, Working Papers 2022