How can I include an Audit Report or Accountants Report in the accounts?

The need for a statutory Audit Report is automatically determined by the options selected within the Start section of the Wizard.

The Wizard will compare the mapped trial balance against the published thresholds for annual turnover and gross assets.

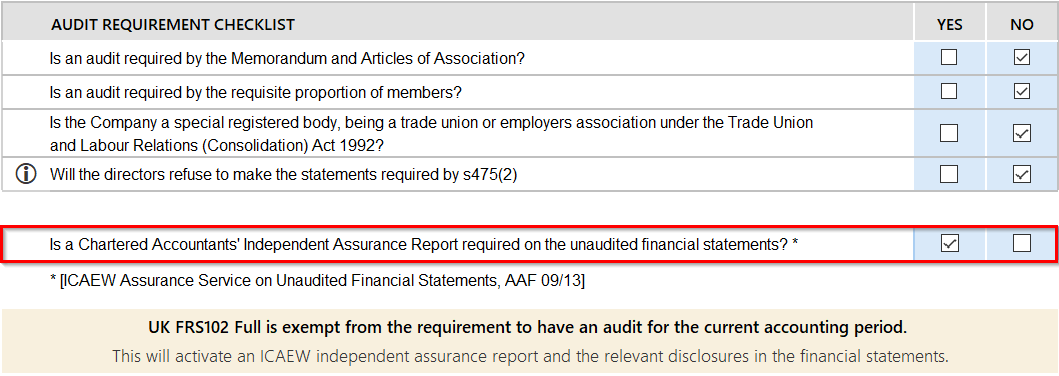

Where the company is exempt from Audit under the criteria, the following table will be shown in the Audit requirement tab.

If you answer Yes to any of the questions, an Audit Report will be included in the accounts.

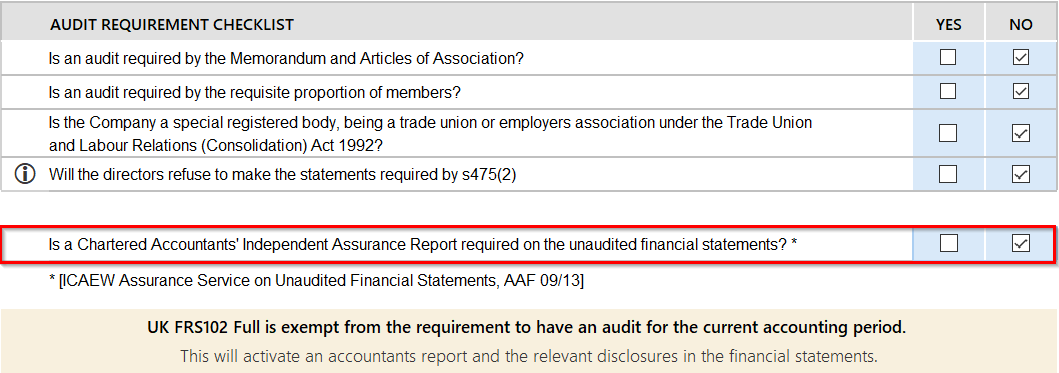

If you answer No to all the questions, audit exemption is claimed and an Audit Report will not be included. There will be a further option to produce the alternative ICAEW Assurance Report.

If you answer No to the requirement for an Assurance Report, this will result in an Accountants Report in the accounts.

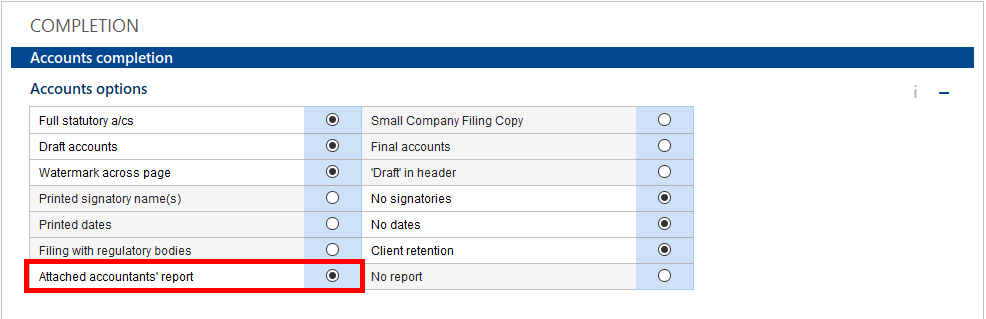

Once this is completed, navigate to the completion section of the wizard and click the radio button Attached Accountants' Report.

Make sure that the accountants report is turned on in the Accounts Preparation Table. This will then be showing in the accounts.

- Related template: AccountsAdv IFRS, Group consolidation, FRS101/102/105 LLP

- Software platform: Working Papers 2022, Working Papers 2023