Retained Earnings Account not Selected on Year End Close

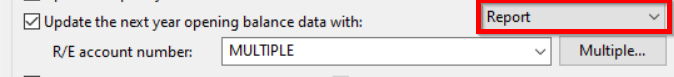

If an opening Trial Balance is required for next year, tick the box labelled Update next year's opening balance data with.

If new balance sheet account numbers had been created in the prior year, use the Multiple Distributing Accounts option to ensure that they are rolled forward correctly.

Any newly created balance sheet account numbers will simply roll forward to the same account number in the next year.

If the opening balance is required on an alternative account code, this can be adjusted by journal entry in the next year or by using the year end close & Roll Forward Multiple Distributing Account screen as follows:

1. Tick the box Update Next year's Opening Balance Data With:

2. Select Report from the drop-down list.

3. Click on the multiple box.

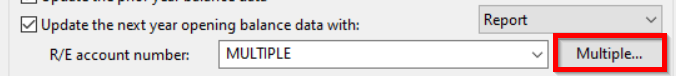

4. Click on Add Distribution box.

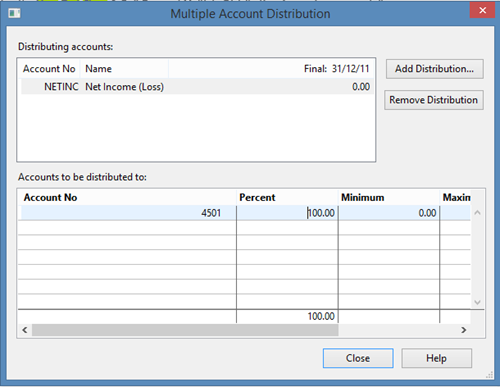

5. Select the account to be distributed from the Trial Balance (i.e. rolled forward to a new account number).

6. Enter the account number to be distributed in the next year on the bottom half of the screen.

7. Enter 100 in the Percent column to ensure the full amount is rolled forward to the new account number.

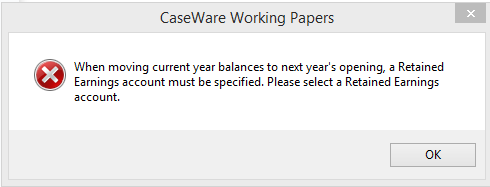

Note: If you receive the following Error message when performing a year end close then you will need to select a retained earnings account number from the multiple distribution button.

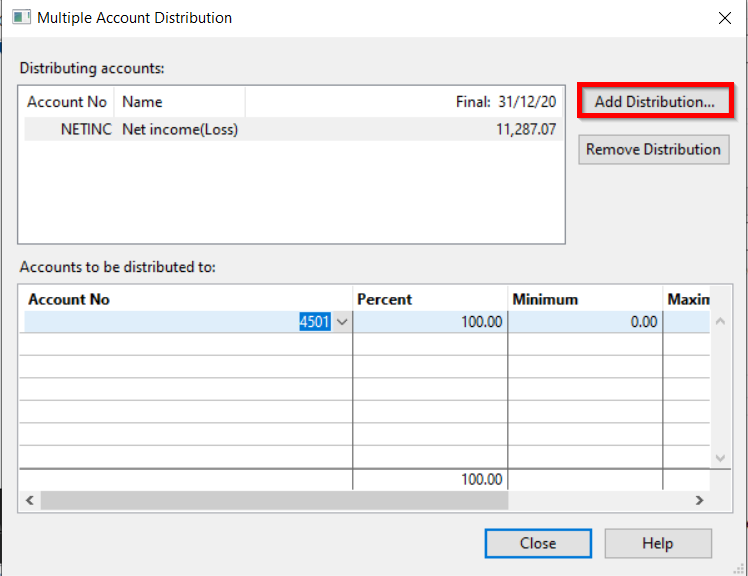

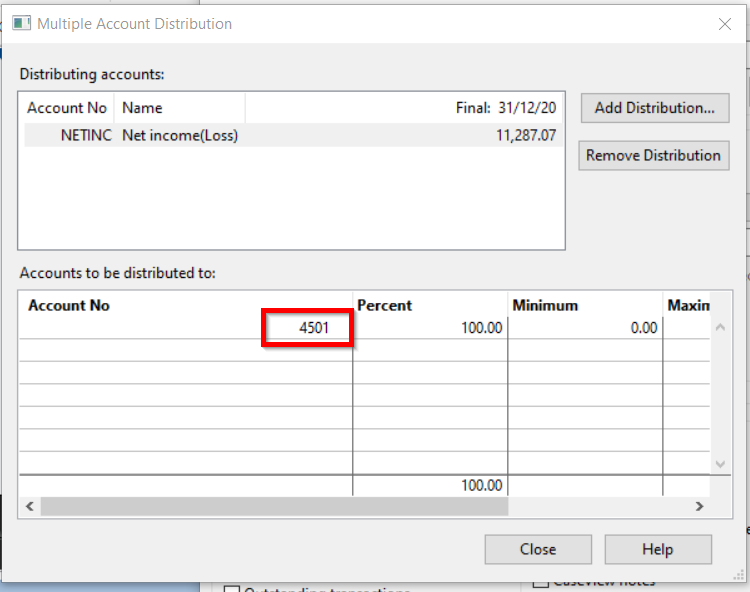

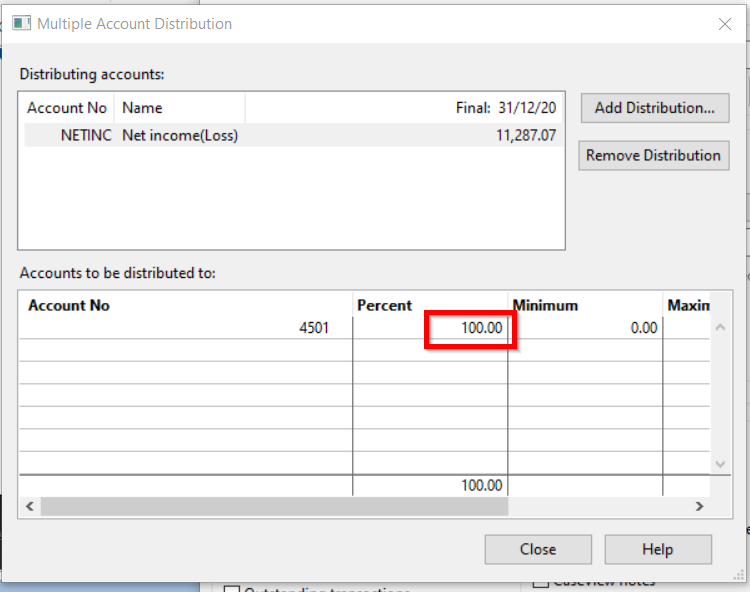

8. To set the RE account click on multiple then select NET INC in the Distributing accounts section:

Then in the Account number section type in the account used for reserves BF i.e. 4501 and select 100%

Note: This must always be 100%.

9. Click close and continue with your year end close procedure

- Related template: None

- Software platform: Working Papers 2018, Working Papers 2019, Working Papers 2020, Working Papers 2021, Working Papers 2022